Hedge Funds, Futures and Cocoa: Why is the Price of Chocolate Rising?

- Manesha Sundar

- Mar 4, 2024

- 3 min read

Amassing almost 70% of the world’s production, Ivory Coast and Ghana are the top two producers of cocoa beans. Given that cocoa is a key ingredient in chocolate production, the price at which the commodity is traded at greatly influences the cost of producing chocolate products. In recent months, natural factors, namely the Cocoa Swollen Shoot Virus Disease (CSSVD) in conjunction with the El Niño sea temperature phenomenon (disrupting rainfall patterns, leading to hot, dry weather in West Africa) have hampered crop yields significantly. Indeed, the virus was responsible for decimating 500,000 hectares of cocoa farmland in Ghana. While natural factors have diminished supply and led to subsequent price rises, the role of market speculation is not to be overlooked when answering this question.

Price reporting manager at Mintec, Andrew Moriarty, notes: “Speculators are knocking the price up, forcing cocoa producers to cover their shorts.”

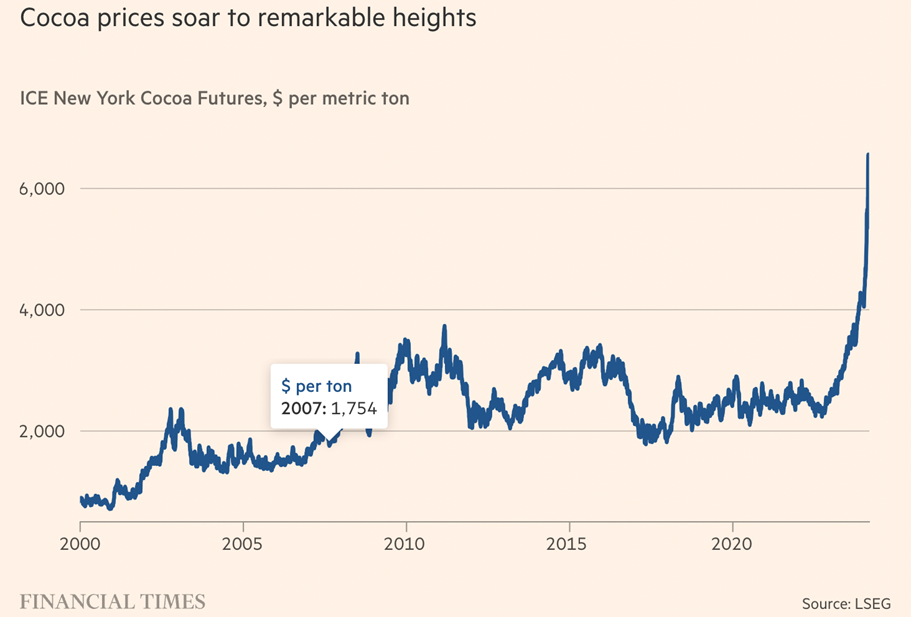

The statement describes a situation whereby speculators are purchasing large volumes of cocoa futures contracts in the cocoa market. The immediate impact of higher demand is an increase in prices of futures contracts, as more buyers enter the market and bid up prices. Hedge funds, many of which engage in speculative activities and have a high-risk exposure, are the agents adding fuel to the fire of rising cocoa prices and are profiting from the short-term price fluctuations. Positive sentiment is a key driver that moves the market as more traders will be attracted by the bullish and optimistic outlook that is being signalled. As a consequence, cocoa producers who had sold their futures contracts prior to this (i.e., took a short position), expecting lower prices are now incurring losses and must “cover their shorts”. In context, data from last week reveals that cocoa futures in London were exchanged at a record high of £5,827 per tonne compared to £1,968, the price it was traded at last year. Prices in New York ($6,648 per tonne) have more than doubled from the same period last year. To cover their shorts, cocoa producers who sold futures contracts (short sellers) must buy back those contracts at the current higher price which essentially closes their short positions.

Besides the inevitable higher prices for sweet-toothed consumers, the unfortunate impact falls on farmers who do not receive the direct gains of higher prices in futures markets. The Ghana Cocoa Marketing Company -a division of the government-controlled body in charge of setting farmgate prices- reports this disparity as ‘Ghanaian farmers are receiving between $1,800 and $1,900 per tonne of cocoa and Ivorian growers about $1,600.’ Abubakar, head of the Marketing Company, remarks that “the current [market] prices will be reflected in the farmers’ pockets at the start of the new season at the start of October.” This delay in farmers’ gains can be attributed to forward contracts that were set by the government over a year ago in some cases, based on sales levels at that time.

In summary, the International Cocoa Organisation forecasts demand to outpace supply by over 370,000 tonnes this year. Tough times do indeed call for tough measures as even big brands like Hershey’s and Callebaut are struggling to absorb the higher costs, resorting to plans of cutting their workforce. In months to come, and more imminently for occasions like Mother’s Day and Easter, chocolate aisles in shops may remain sparse or rather there will be more-than-usual deliberation over which item of confectionery to purchase. Perhaps, curtailed chocolate consumption can be seen as a challenge set by the markets to find healthier alternatives to celebrate and relish sweet times.

Key terms:

Speculators: individuals or entities who participate in financial market activities with the main goal of making a profit from short-term price movements in assets like stocks, bonds, commodities, currencies, or derivatives. They capitalise on price fluctuations that occur within shorter timeframes. In comparison, investors typically take a long-term stance, seeking to generate returns over time.

Futures contracts: standardised agreements to buy or sell a specified quantity of a commodity or asset at a pre-determined price on a future date.

Hedge Funds: investment funds that pool capital from accredited investors (individual or institutional) and work to generate favourable returns for their investors. Due to having fewer regulatory constraints, they tend to have more flexible strategies and take higher risks than other types of funds.

Farmgate prices: The prices farmers receive for the output they sell directly from their farms. They are a vital element in the agricultural supply chain, determining the ability of farmers to maintain production as well as affecting consumer prices down the supply chain.

Comments